| Alternative Markets and E&S Lines | |||

|

|||

|

|

|||

|

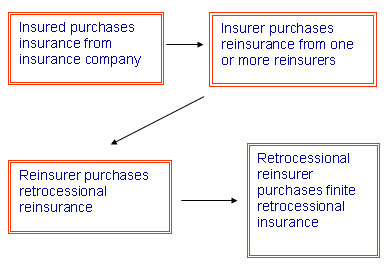

Insurance companies and their relationships Let's now take a look at insurance companies themselves as relates to the E&S marketplace. Insurance companies can be categorized in a variety of ways. Some groupings include: Foreign insurer A foreign insurer may be admitted or non-admitted to write insurance in a given state. Alien insurer An alien insurance company typically operates as a non-admitted carrier. An example would be Lloyds of London and "offshore" companies such as those formed in the Cayman Islands. Admitted insurer An admitted insurer could be either a foreign or alien company that has a certificate of authority (license) to transact insurance in a given state. An admitted carrier in most states must file rates they use by class and any changes to those rates. All premiums and losses are reported to the Department of Insurance. Admitted insurers are subject to strict regulation in states in which they operate as relates to rates and forms. An admitted carrier typically writes lines of business that have good statistical information and history in order to be able to develop an adequate risk profile. Advantages of admitted insurance include: Non-admitted insurer A non-admitted carrier is one who is not licensed to write business in a given state by that state's department of insurance. However, the insurer must be approved by the DOI. Status as a non-admitted carrier typically allows more flexibility in writing business. A non-admitted carrier must do business through a licensed surplus lines broker. A risk cannot be placed in a non-admitted market unless it has been rejected by three admitted carriers first that are authorized to write that class of business. The non-admitted carriers are indicated on the List of Eligible Surplus Line Insurers (LESLI). For those agents in California, it is important to note that one of the advantages of being an admitted carrier is eligibility for California Guarantee Insurance Association (CIGA). Non-admitted insurers are not eligible to participate in CIGA. Some non-admitted carriers have their own guarantee funds. When an insured accepts an insurance policy through a non-admitted carrier they must sign and return the disclaimer notice required by the state. Either the broker or surplus lines broker must complete a Diligent Search Report prior to placing with non-admitted insurer. As mentioned earlier, all insurance lines are required to obtain at least three rejections from a standard market admitted insurer. The proper insurer name must be listed, not the generic parent name. For example, Chubb is not acceptable; you need to specify the subsidiary declining the risk. Different requirements may exist to comply with DOI regulations surrounding such areas as personal auto risk and small employer health plan coverages. There may also be classes of business for which a Diligent Search Report is not required-check with your DOI for specifics on Diligent Search Reports and required filings. Reinsurance The basic purpose of all reinsurance is to spread losses-to protect an insurance company against one or more very large individual losses or against the accumulation of a number of losses from one event. A primary (ceding) insurance company writes insurance for the insured. A reinsurer agrees to take over some part of the risk from the ceding insurance company. Most insurance companies place some limit on the size of any risk they accept. For example, a company may choose to retain only the first $100,000 of any General Liability contract. So another function of reinsurance is to increase the flexibility of an underwriter in the size and types of risk and volume of business they can accept. Treaty reinsurance With treaty reinsurance, the ceding insurance companies negotiate a contract over their entire line(s) of insurance with a reinsurer. The ceding insurer often has a deductible per line and an aggregate stop loss arrangement whereby they transfer catastrophic loss per insured and per book to another insurer. Facultative reinsurance Facultative reinsurance is generally used when a risk is too large or hazardous. An insurer purchases reinsurance on a specific insured (or group of insureds). The insurer negotiates retentions and stop loss on the specific risk. It is negotiated individually on a risk-by-risk basis so that the reinsurer has no obligation to accept it. Retrocession reinsurance To spread a fairly substantial risk among a number of insurance companies, a reinsurer may reinsure some of the risk it has assumed. This type of agreement is known as retrocession. Many layers of retrocessional reinsurance may exist in either treaty or facultative form, resulting in something referred to as "finite retrocessional reinsurance". This generally comes into play in catastrophic losses. The insurance chain

Reinsurance pools In a pool arrangement, a number of primary insurers agree to place all business of a certain type into a pool. Each member of the pool gets a prearranged percentage of the total premiums and pays an agreed percentage of all losses. Reinsurance pools are basically an extension of the treaty reinsurance idea. Many reinsurance pools have been created to handle specific classes or business, such as marine, aviation, or nuclear. Self-insurance Self-insurance means that in some way the insured will participate in the funding of its losses. While there may be substantial benefits, there may be substantial risks as well. The self-insurance option is based on the insureds financial ability to pay first-dollar losses. Self-insurance can be conducted with a standard carrier basis through high self-insured retentions (deductibles) or through captives. Reinsurance over self-insurance Many risk managers turn to reinsurance companies for excess or stop loss coverage above some type of self-insurance programs. Typically, the insured absorbs or retains an initial loss up to some pre-determined amount, e.g., $150,000 per occurrence. The stop loss coverage protects against catastrophe losses in excess of that amount. A stop loss is basically a guarantee from one company (the reinsurer) to another (the reinsured) that losses over and above an agreed amount will be paid by the reinsuring company. Captives A pure captive insurance company is one with a limited purpose, existing as a wholly owned insurance subsidiary of an organization not in the insurance business. Its primary function is insuring some of the exposures and risks of its parent or affiliates of the parent. It must observe and operate under the same legal constraints that govern any insurance company domiciles in that jurisdiction. Profit-making captives insure risks unrelated to their owners as well as their owners. Association (or multiple owner) captives can be formed by trade associations or groups of individuals or organizations to solve a common problem. An example would be the American Hospital Association, which comprises more than 20 groups of hospitals forming an offshore captive with the intent of obtaining malpractice insurance at rates lower than those offered by conventional carriers. Captives do come at a cost: However, the ultimate savings may well be worth the costs. Risk retention groups The Liability Risk Retention Act of 1986 provided that risk retention groups and purchasing groups could be formed to provide or obtain protection against nearly all types of commercial liability risks. It facilitated the formation of self-insured or insurance buyer groups by overriding state laws that impede or prohibit them. A group formed under the Liability Risk Retention Act is required to become a chartered and licensed liability insurance company under the laws of only one state or the District of Columbia. A risk retention group must be formed with the primary purpose of assuming or spreading the exposures of its members and must consist of members with similar exposures. It provides bulk buying for homogenous groups, tailor-made coverage for an industry or profession, broader terms, lower pricing, target loss control, and risk management. Fronting companies Most of the "pure" captives and many of the association captives that have been set up offshore use a conventional, domestic insurance company as a "front". Under a fronting arrangement, the insured pays a premium directly to the front and all or some portions (usually a substantial portion) of the risk is then reinsured in the offshore captive. The fronting company issues the policy, makes whatever filings are required by state laws, provides loss prevention and safety engineering services, and provides certificates of insurance when needed. The range of services provided by the fronting company is negotiable as are the prices for the services. |

|||

|

Next Page >

|

|||

|

| |||

|

© Copyright CEfreedom.com and Insurance Skills Center. All Rights Reserved. |

|||

|

Not only are policy forms, clauses, rules and court decisions constantly changing, but forms vary from company to company and state to state. This material is intended as a general guideline and might not apply to a specific situation. The authors, LunchTimeCE, Inc., CEfreedom, and Insurance Skills Center, and any organization for whom this course is administered will have neither liability nor responsibility to any person or entity with respect to any loss or damage alleged to be caused directly or indirectly as a result of information contained in this course.

|