| Business in the Home | |||

|

|||

|

|

|||

|

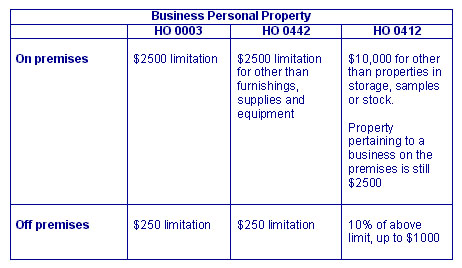

Business personal property NOTE: This is entitled "personal property" with the implication being that coverage applies to that property owned and used personally by the insured. The coverage is worldwide. HO 0003 Homeowner's As relates property used for business, there are two limited allowances under Special Limits of Liability numbers 8 and 9: HO 0442 Permitted Incidental Occupancy The Permitted Incidental Occupancy endorsement eliminates the restriction for the "described" business as relates to Business Personal Property on premises. The full Coverage C limit will be available for on premises furnishing, supplies and equipment of the described business. This does not modify the restriction as relates to stock on or off the premises. This does not modify the restriction off premises for $250. HO 0412 Increased Limits on Business Property The H0 0412 does not apply to a "business" actually conducted on the "residence premises". The endorsement allows for the increase of the $2500 On Premises restriction up to a maximum of $10,000. It allows for the increase of the Off Premises restriction of $250 to 10% of the limit written for On Premises. Coverage for property held in storage, as a sample, or sale or delivery after sale is not covered or increased by this endorsement.

Property not covered The following property is not covered by Homeowner's insurance. HO 0414 Special Computer Coverage In the absence of this endorsement, the HO 0003 covers a computer on premises, bought for business, for up to $2500.00. The HO 0003 does not increase the limit of liability under Coverage C and does not modify the "special limits of liability" or the provisions of property not covered under Coverage C. This endorsement modifies the perils to All Risk; it is not be used when an HO 0003 has a HO 0015 endorsement as the HO 0015 redefines the personal property to "All Risk". Fair rental value Under Coverage D--Loss of Use--the insured can choose to either apply coverage as Additional Living Expense or Fair Rental Value. "Fair rental value" is defined as fair rental value of that part of the "residence premises" rented to others or held for rental by you less any expenses that do not continue while the premises is not fit to live in. Payment will be the shortest time required to repair or replace that part of the premises rented or held for rental. The limit provided for Coverage D is typically 20% of Coverage A. Credit card Credit card, fund transfer card, forgery and counterfeit money is covered for $500.00 and can be increased with the HO 0453. Coverage does not apply to loss arising out of "business" use or the insured's dishonesty. Coverage only applies for cards issued in the insured's name. |

|||

|

Next Page >

|

|||

|

| |||

|

© Copyright CEfreedom.com and Insurance Skills Center. All Rights Reserved. |

|||

|

Not only are policy forms, clauses, rules and court decisions constantly changing, but forms vary from company to company and state to state. This material is intended as a general guideline and might not apply to a specific situation. The authors, LunchTimeCE, Inc., CEfreedom, and Insurance Skills Center, and any organization for whom this course is administered will have neither liability nor responsibility to any person or entity with respect to any loss or damage alleged to be caused directly or indirectly as a result of information contained in this course.

|