| Directors and Officers Liability (Part 1) | |||

|

|||

|

|

|||

|

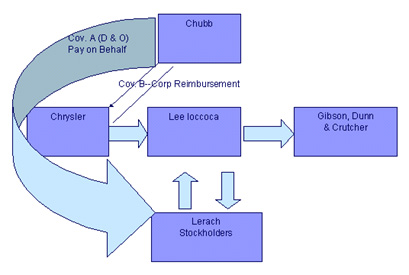

Insuring agreements Coverage A and Coverage B Coverage A provides Directors & Officers Liability coverage. That is, it covers liability incurred for wrongful acts committed while acting in that capacity. It pays when the corporation cannot indemnify its directors and officers. Coverage B provides corporate reimbursement. That is, it reimburses the corporation for costs incurred to indemnify directors and officers for such liability. How is works: Coverage A vs. Coverage B Let's use former Chrysler CEO Lee Ioccoca as an example of how Coverage A and Coverage B work. See the image below.

Allocation issues with D&O Liability Insurance Directors and Officers Liability Insurance offers no coverage for liability incurred by the corporation beyond the duty to indemnify directors and officers. Therefore, if a suit names both the corporation and directors/officers, the portion of loss allocated to the corporation is uninsured. The marketplace response to this situation is to provide entity coverage and include pre-set allocation amounts into policies. Let's consider an example of a $5 million corporate insurance policy. In this policy, 40% allocated to entity ($2,000,000) and 60% allocated to directors and officers ($3,000,000). The deductible is set at $500,000. In a case with a settlement of $2,500,000, with 5% participation amounting to $125,000, the total loss including defense would be $2,375,000. In new insuring agreements, Coverage C applies to corporate entities. It covers the corporate entity for loss incurred by the corporation directly--separate from the Directors and officers losses. According to the Tillinghast -Towers Perrin Survey (2001), around 90% of the surveyed companies purchased entity coverage, up 30% from 4 years ago. For some companies, there is no charge for entity coverage. Moreover, entity coverage is provided for some companies only if there is concurrent liability; that is, the directors and officers must be included in the suit, as well. Entity coverage may be matched to the way losses come in. And what about lawsuits brought about by acts of employees, agents, or other third parties such as accountants and attorneys? It may still be possible to subrogate back against uninsured parties. So why is the new insuring agreement important? There are a several good reasons. Entity coverage avoids allocation battles between insured and insurer over covered directors and officers and uncovered corporate entity. A corporation can act on the collective efforts of many persons who may not be individually liable. Entity coverage covers a corporation named in a suit not directed at directors or officers. This is important because when no director or officer is named in the suit, the D&O policy has no duty to respond with reimbursement for loss. Another reason the new insuring agreement is useful is that it is readily available in the non-profits market as well as for profit arena The downside to having the new insuring agreement is the reduction of limits available for Directors and Officers Liability Insurance. Four retentions Four retentions comprise a Directors and Officers Liability Insurance policy: Concerning deductibles, the Coverage A policy (Directors and Officers Liability Coverage) may be written with a separate per-claim deductible applicable to each director and officer or with a per loss aggregate. Coverage B (Company Reimbursement Coverage) can have a deductible per loss and is often much larger than the Directors and Officers Liability coverage deductible. The deductible is applicable to defense costs. The policy should contain an anti-stacking provision that states if the wrongful act(s) results in more than one claim, only one deductible shall apply. Occasionally insurers will insert a specific exclusion applicable to certain types of allegations, such as anti-trust or price fixing. Coverage A sample insuring agreement So when is Coverage A used? Coverage A comes into effect when state or federal regulations will not allow indemnification. This could be when there has been a breach of loyalty or in derivative action suits (depending on that state's corporation code). Coverage A is also used when corporations cannot indemnify because of insolvency. Here is a sample Coverage A insurance agreement: "The company shall pay on behalf of each of the insured persons all loss for which the insured person is not indemnified by the insured organization and which the insured person becomes legally obligated to pay on account of any claim first made against the insured person, individually or otherwise, during the policy period or, if exercised during the extended reporting period, for a wrongful act committed, attempted, or allegedly committed or attempted by such insured person before or during the policy period." In the sample above, note that the wording should be "pay on behalf of" rather than "reimburse" or "indemnify." Coverage A responses only when the insured is not indemnified by the company. Coverage A is written on a claims-made basis. It should respond when the claim is first made during the policy period or the extended reporting period, whether or not the "wrongful act" was committed during the policy period. Also, there should be no retroactive date nor a statement to cover full prior acts Coverage B sample insuring agreement Here is a sample Coverage A insurance agreement: "This policy shall reimburse the company for loss arising from any claim or claims which are first made against the directors or officers and reported to the insurer during the policy period or the Discovery Period (if applicable) for any alleged wrongful act in their respective capacities as directors or officers of the company, but only when and to the extent that the company has indemnified the directors or officers for such loss pursuant to law, common or statutory, or contract, or the charter or by-laws of the company duly effective under such law which determines and defines such rights of indemnity." Coverage B is written on a claims-made basis or claims-made-and-reported basis. It is often written to reimburse the company for amounts paid to its directors and officers. The two insuring agreements shown above for Coverage A and Coverage B are complimentary to one another. If possible, try to obtain "pay on behalf of" language instead of "indemnify" for this insuring agreement. This decision varies by client. |

|||

|

Next Page >

|

|||

|

| |||

|

© Copyright CEfreedom.com and Insurance Skills Center. All Rights Reserved. |

|||

|

Not only are policy forms, clauses, rules and court decisions constantly changing, but forms vary from company to company and state to state. This material is intended as a general guideline and might not apply to a specific situation. The authors, LunchTimeCE, Inc., CEfreedom, and Insurance Skills Center, and any organization for whom this course is administered will have neither liability nor responsibility to any person or entity with respect to any loss or damage alleged to be caused directly or indirectly as a result of information contained in this course.

|