| Principles of Insurance (Part 2) | ||||||

|

||||||

|

|

||||||

|

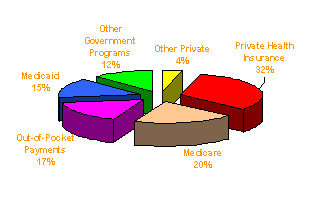

Lines of insurance One of the very basic principles of insurance is that insurance is comprised of different types of coverages for different types of risks or exposures. In this lesson, we will look at the four basic lines of insurance: Life insurance According to the National Association of Insurance Commissioners (NAIC) there were 1,796 insurance companies in l997 that sold life and health insurance. That compares to 3,366 that wrote property and casualty insurance during the same timeframe. In simple terms, life insurance is designed to pay benefits to designated survivors in the event of an insured's death. People buy life insurance in order to: Health and disability insurance Health and disability insurance reimburses the insured for such issues as: In l997 total national health care expenditures amounted to $1.1 trillion or almost $4,000 per capita. The government's large-scale participation in providing health care through Medicaid and Medicare makes comparisons difficult between the health care sector and the life and property / casualty sectors, which are mostly private. The nation's health care dollar: where it came from (1997)

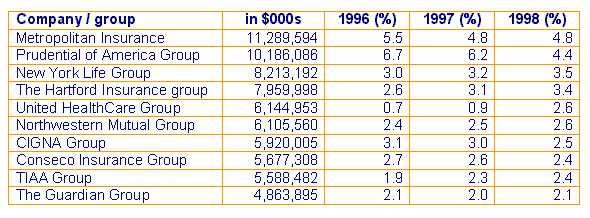

Leading writers of life / health insurance

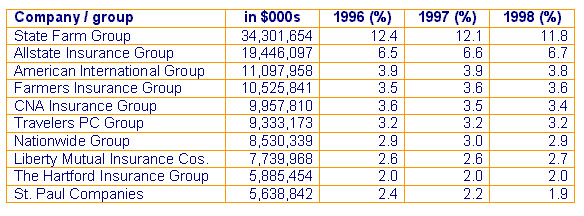

Property insurance Property insurance is designed to protect the owner or holder of property from incurring a financial loss. There are many classes of property that might be insured such as: Property forms also deal with additional expenses or income losses that an insured would suffer because their property is damaged. Liability / casualty insurance Liability or casualty insurance is a more difficult line of insurance to define. One of the simplest concepts concerning liability is the risk (possibility) that an insured will suffer financial loss as a result of their actions toward another (third party). If an insured hurts somebody or damages someone's property negligently or wrongfully then the insured will have to pay for those damages. This is referred to as "legal liability" and the amount the insured has to pay the third party is called "damages". An example would be if you rear-ended another vehicle and injured the driver of the other car. The person that makes the claim is called the "third party" and for that reason, liability insurance is sometimes referred to as "third party" insurance. The insured is the first party, the insurance company is the second party and the claimant against the insured is the third party. Property insurance and liability / casualty insurance are often seen as going hand-in-hand. For example, when you take out insurance on your car, you would looking into getting both collision insurance to cover damage to your car and liability insurance to protect against any expense that you would incur if you injured someone else and their car. Leading writers of property / casualty insurance

U.S. property / casualty net To give you an idea of how much money was spent for different property / casualty coverages in the States, here are the premiums written by line in 1998 (in $000s): Private passenger auto liability 70,654,316 Collision & comprehensive 46,636,351 Total private passenger auto 117,290,667 Commercial auto liability 12,978,898 Collision & comprehensive 5,119,953 Total commercial auto 18,098,942 Total automobile 135,389,609 Medical malpractice 5,415,066 General liability 19,017,955 Fire and allied lines 9,037,541 Homeowners multiple peril 28,982,711 Farm owners multiple peril 1,434,441 Commercial multiple peril 18,973,101 Workers compensation 23,184,061 Inland marine 5,765,993 Ocean marine 1,833,240 Surety and fidelity 4,912,821 Burglary and theft 107,966 Boiler and machinery 774,283 Aircraft 843,638 Accident and health 9,842,181 Other lines 5,284,946 TOTAL (all lines) 281,508,998 |

||||||

|

Next Page >

|

||||||

|

| ||||||

|

© Copyright CEfreedom.com and Insurance Skills Center. All Rights Reserved. |

||||||

|

Not only are policy forms, clauses, rules and court decisions constantly changing, but forms vary from company to company and state to state. This material is intended as a general guideline and might not apply to a specific situation. The authors, LunchTimeCE, Inc., CEfreedom, and Insurance Skills Center, and any organization for whom this course is administered will have neither liability nor responsibility to any person or entity with respect to any loss or damage alleged to be caused directly or indirectly as a result of information contained in this course.

|