| M&A, Bankruptcy, and Insurance (Part 1) | |||

|

|||

|

|

|||

|

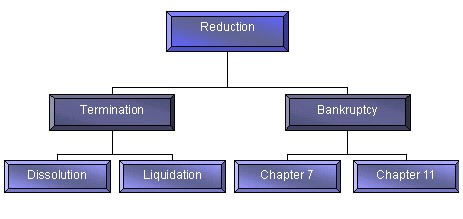

Reduction: termination and bankruptcy Transition via reduction

Your clients might choose reduction of their company for a variety of reasons. Surprisingly, both parties to the buy / sell situation have issues that are related to each other. Though the two parties may have diametrically opposed views of risk, there is commonality of issues between the two parties. This is something to bear in mind, as you may find yourself advising clients from either of these buyer or seller perspectives. Termination Termination of the company can be divided into two facets: dissolution and liquidation. "Dissolution" is the legal death of the artificial person who constitutes the "corporation". "Liquidation" is the process by which corporate assets are converted into cash and distributed among the creditors and shareholders according to specific rules of preference. Exposures to future litigation for past actions still exist. Additionally, directors and officers can still be held liable under tort. Bankruptcy The provision of bankruptcy was first enacted in 1898, established by federal law under the U.S. Constitution. Congress created the Uniform Laws of Bankruptcies throughout the U.S. as a federal act. Significant recent bankruptcies include: By the end of 2002, the U.S. witnessed the largest volume of bankruptcies ever declared in a single year (in terms of assets), though 2001 had a higher number of companies filing Chapter 11. Current bankruptcy law is based on the Bankruptcy Reform Act of 1978. Further significant changes were made by the Bankruptcy Reform Act of 1994. The goal of bankruptcy is to protect a debtor by giving him or her a fresh start free from creditors' claims, and to ensure equitable treatment to creditors competing for the debtor's assets. Bankruptcy and insolvency of the insured will not relieve the insurance carrier of its obligations. Chapter 7 Chapter 7 is the most common form of bankruptcy. It is available to all forms of entities, including individuals. This is a liquidation proceeding in which the debtor's non-exempt assets, if any, are sold by the Chapter 7 trustee. Proceeds are distributed to creditors according to the priorities established in the code. Any wages earned by the debtor AFTER the case has begun are the debtor's and beyond the reach of creditors. Chapter 11: reorganization Typically, Chapter 11 is filed by corporations or partnerships. The debtor usually remains in possession of the assets and continues to operate the business. When filing Chapter 11, the debtor proposes a plan for reorganization that: Repayment of debt may be accomplished: |

|||

|

Next Page >

|

|||

|

| |||

|

© Copyright CEfreedom.com and Insurance Skills Center. All Rights Reserved. |

|||

|

Not only are policy forms, clauses, rules and court decisions constantly changing, but forms vary from company to company and state to state. This material is intended as a general guideline and might not apply to a specific situation. The authors, LunchTimeCE, Inc., CEfreedom, and Insurance Skills Center, and any organization for whom this course is administered will have neither liability nor responsibility to any person or entity with respect to any loss or damage alleged to be caused directly or indirectly as a result of information contained in this course.

|